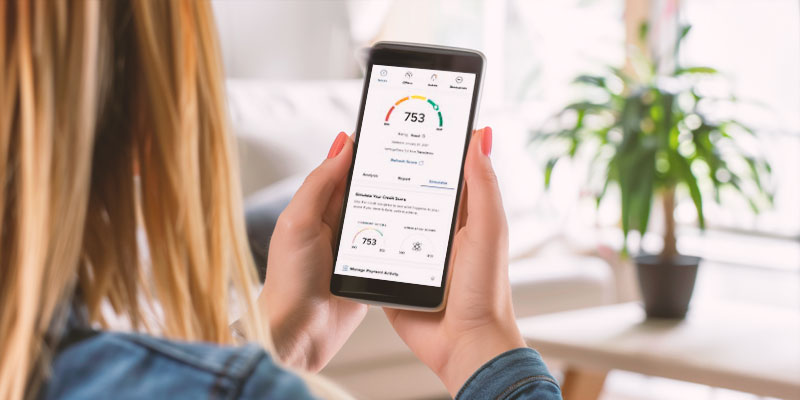

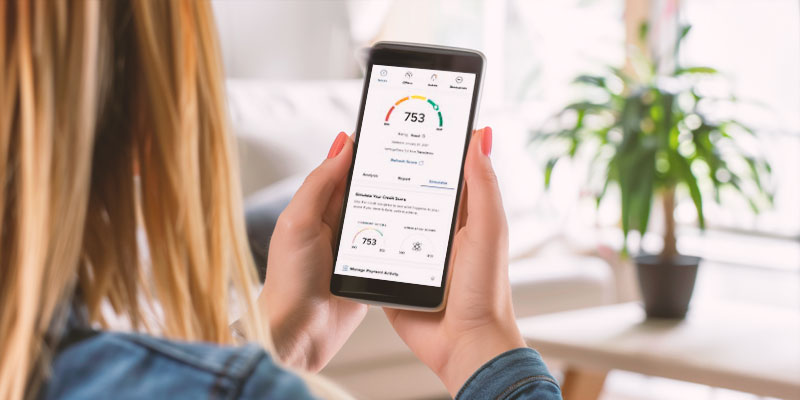

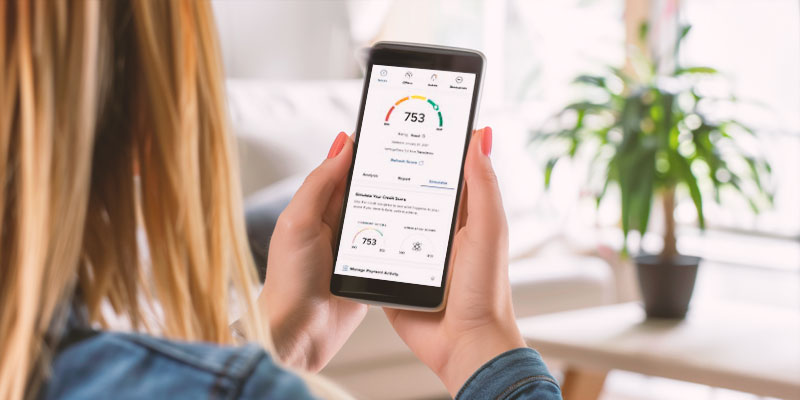

by Karen Wotherspoon | May 17, 2024 | Blog, Finance

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

by Karen Wotherspoon | May 3, 2024 | Blog, Finance

Real estate has proven to be a sound long-term investment. If you’re thinking about buying an investment property, consulting with your trusted mortgage agent is a terrific place to start. Your agent can play a crucial role by providing valuable expertise throughout...

by Karen Wotherspoon | Apr 19, 2024 | Blog, Homeownership

April 2024 has been an active month for news impacting mortgage borrowers! The 2024 federal budget contained some benefits for first-time homebuyers, which is a step in the right direction. In addition, the federal government announced big plans the mortgage industry...

by Karen Wotherspoon | Apr 5, 2024 | Blog, Homeownership

Saving for a down payment is often one of the greatest barriers to homeownership. Fortunately, a First Home Savings Account (FHSA) encourages Canadians to intentionally plan ahead for your entrance into the housing market. First introduced by the federal government...

by Karen Wotherspoon | Mar 15, 2024 | Blog, Homeownership

Buying your first home is extremely exciting, but it also takes a lot of planning, including building a realistic budget that helps ensure you can afford to carry all the expenses that come along with homeownership. Here are the key homebuying costs to include in your...

by Karen Wotherspoon | Mar 1, 2024 | Blog, Mortgage

For many homeowners, securing a mortgage is a significant financial milestone. But, it’s just as important to regularly review and optimize that mortgage. This is where your mortgage agent becomes even more invaluable – proactively looking out for your best interests...