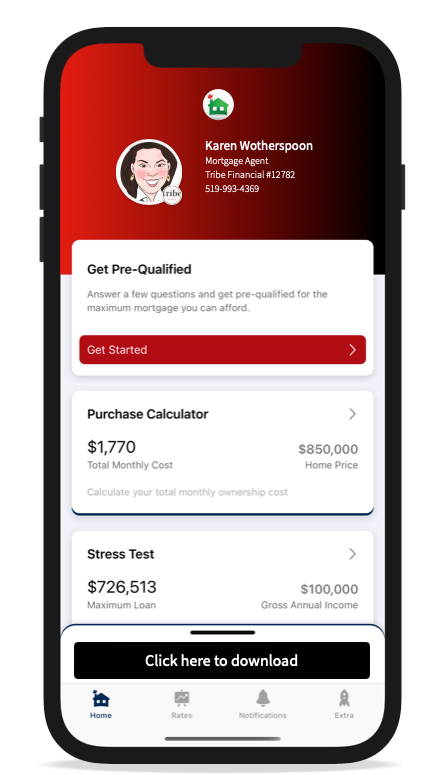

Karen Wotherspoon

Mortgage Agent- Level 2

Karen Wotherspoon is a customer focussed mortgage lending professional with over 23 years of experience in the financial services industry. She shines in helping people make their home ownership dreams come true and finds that silver lining when working through difficult client situations.

Karen takes great care in getting to know the personal story of her clients and their financing needs, and is committed to finding the right solution for them. She specializes in helping first time home buyers, new immigrants to Canada as well as clients who are self-employed and arranges mortgages for purchases, refinances, renewals & transfers as well as reverse mortgages.

One of her most rewarding experiences, albeit a personally difficult situation for her, was advising a friend with cancer that she had the right mortgage insurance coverage but was unaware that she didn’t have to make mortgage payments while she was off work fighting the disease.

Karen holds a Bachelor of Commerce Honours degree from the University of Guelph, double majoring in management and economics. She has also achieved the Accredited Mortgage Professional certification from Mortgage Professionals Canada, a national mortgage broker industry association.

There’s strength in numbers.

Confidence, too. And the confidence that comes with having the numbers on your side starts with having the right people on your side. People who speak numbers, speak your language and whose reputations speak for themselves. People who understand your goals and work with you to meet them. People like you. For trusted financial advice and service that makes you feel like you belong.

Join the tribe.

Mortgage

Services.

Customer Care

I believe that my responsibility as a mortgage expert goes well beyond simply arranging your mortgage financing. My job is to ensure that you feel confident in the mortgage process and make decisions that best suit you and your tribe.

Education

In order for you to feel confident about the mortgage process and make the best decisions for your tribe, you have to feel at ease and be able to ask questions. I stay in touch with you throughout the entire process, provide information up front, but also make myself available whenever you need me!

Best Mortgage Products

Being a part of the tribe has advantages. Access to the best lender products available anywhere in Canada is one of them. We use our extensive corporate networks to ensure you get the best mortgage product. It pays to belong.

Lenders.

We have developed excellent relationships with several lenders, let’s figure out which one has the best products to offer you!

10 Tips for Saving Your Down Payment on a Home

Saving for a down payment on a home can be challenging but, with careful planning and discipline, this important milestone will become much more easily achievable. Following are 10 helpful tips to get you started on your homeownership journey as soon as possible. 1....

Have You Thought About Buying a Place for Your Post-Secondary Children?

College and university residence spaces and local rental opportunities are tight in many areas with concentrated amounts of student population. That’s why it may be a great idea to consider buying a home for your child and their friends/roommates to live in while...

Signs to Look for to Help Prevent Mortgage Fraud

Mortgage fraud is a serious issue in Canada that is becoming extremely sophisticated, and can lead to significant financial loss and long-term complications for borrowers. To safeguard against this threat, as a potential homebuyer or mortgage borrower, there are...